Subscribe Now - Standard: only $299 per year or Premium: only $399 per year - Click Here

|

|

Login:

Friday Recap - 20th March 2020Yesterday I was feeling somewhat confident that the cornavirus would peak in April or May and then the economy could begin to come back to life. I thought that perhaps by the end of summer, the economy could be back on its feet. However, then California and New York ordered all non-essential businesses closed without a date of when work would resume. The fallout from this virus is still unknown, but we know that the number of cases is only now starting to expand. That means it will be a while before it is contained. How will they restart businesses in 4-8 weeks if there are more cases then than now?

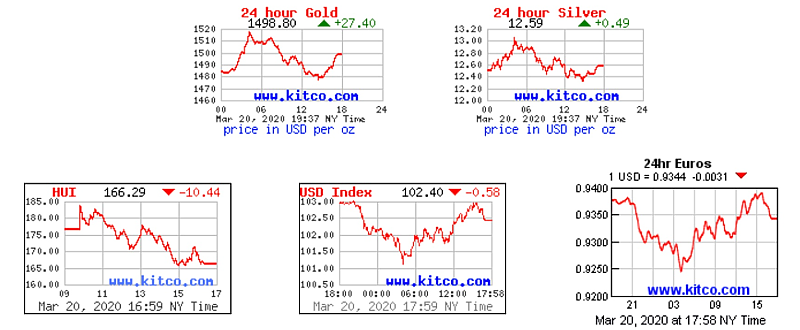

Well, we did get our recession. It's here and not going away anytime soon. Just like in 2008, the PMs and PM stocks have sold off. I thought that gold would get a bid, and kind of has, currently at $1480. But silver has not followed. The GSR is currently at a stunning (1498/12.59) 119! I never expect that. I do expect it to contract at some point. Those who think silver is dead and will never again reach a sub 50 or sub 30 GSR are likely to be proven wrong. The miners have gotten wrecked. Today, gold was up $27 and the HUI was down 5.5%. Part of this has to do with the coronavirus. Investors are concerned about miners closing down. Now we wait. The bond market is being strained, plus real interest rates are negative, plus dollars are being printed like there is no tomorrow. At some point, I would expect gold to get a bid. And if gold gets a bid and jumps to higher levels, then silver should get a bid. The retail crowd likes to buy physical silver during these financial crises, and it will all be gone soon. You probably can't find any silver bars in stock.  |

Follow