Subscribe Now - Standard: only $299 per year or Premium: only $399 per year - Click Here

|

|

Login:

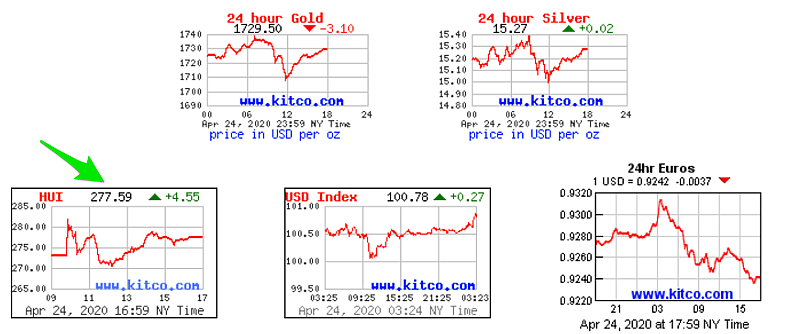

Friday Recap - 24th April 2020This was a flat week, but that was good for the miners. The longer gold is over $1700, the more cash flow producers accumulate. This is why the HUI closed at 277 today. Balance sheets are improving. The average gold producer has all-in costs around $1200 to $1300. So, free cash flow is up significantly.

It wasn't that long ago (March 23rd) when the HUI was under 200. So, we have had a big move in a short period of time. Many are calling this a breakout and that now we are going much higher. The GDX closed over $32 this week, which was an important breakout point. We shall see if there is follow through. I'm still concerned about two things. First, silver has not joined the party. Until silver breaks out, I will be apprehensive. Second, the stock market is likely to go lower. If we get a big sell-off in the markets, then the miners will likely follow stocks down. Even with these two negatives for the miners, gold has a plethora of positives. It does not look like gold is going to break down. Other than the dollar, gold is at all-time highs against most currencies. So, if gold is resilient, then the miners could withstand a market sell-off. I want to see two things: 1) Silver to catch on fire and get above $18.50. 2) Gold to get above $1800 and stay there for a month. Then I will proclaim a bull market in gold. Note that I did say on numerous occasions last year that if gold got above $1450, we would likely see a new high. I still feel that way. It will be hard for gold not to trend to a new high.  |

Follow