Subscribe Now - Standard: only $299 per year or Premium: only $399 per year - Click Here

|

|

Login:

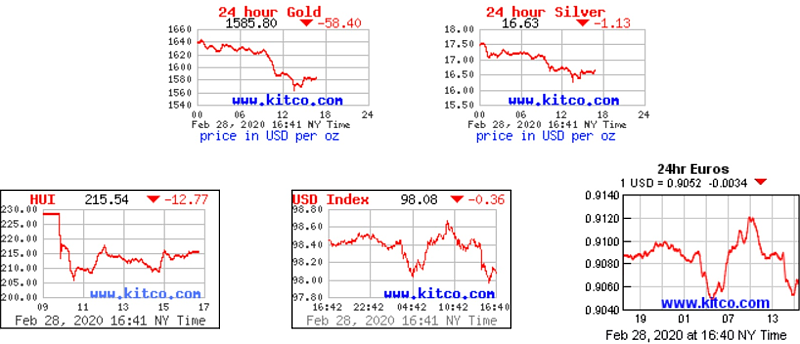

Friday Recap - 28th February 2020Wow, what a week! The markets were down about 10% and it dragged down gold and silver with it. I was not expecting that and learned something new with this crash. What I learned is that gold does not hedge against a stock market crash. Instead, it hedges against a bond market crash. Bonds are a lagging indicator. Bonds crash after the economy crashes. The stock market is a leading indicator. So, if the Corona virus causes a recession, then bonds will falter and gold (and silver) will rise.

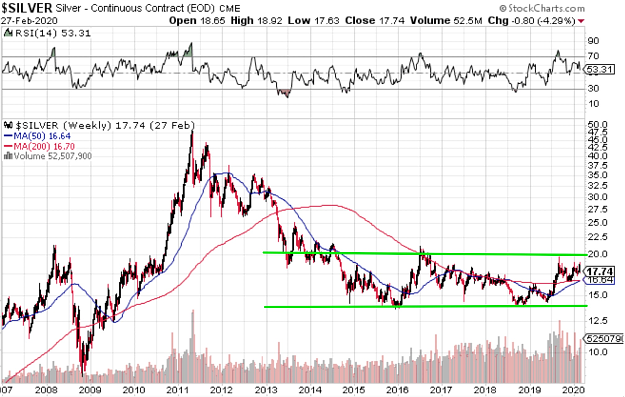

The odds have increased for a recession, so this may be a blessing in disguise. It may appear that we getting killed this week (your portfolio is likely down more than 15%), but if the fear-trade is back, then gold will begin rising soon. Gold rallied from 2009 to 2011 in a big way the last time investors got nervous about bonds. Looking at the silver chart below, what stands out to me is the lower band of the channel that began in 2013. I think that lower band will hold. That means we are very close to a bottom in silver. Anything sub $16 seems like a steal to me. We could see sub $15, but why wait? $15.50 looks like a good target. Get ready.   |

Follow