Subscribe Now - Standard: only $299 per year or Premium: only $399 per year - Click Here

|

|

Login:

Friday Recap - 27th March 2020As a gold/silver mining investor, I have mixed feelings this week. On the one hand, I should be exhilarated that Washington has once again lost its mind and is printing money like a banshee, pretending that debt doesn't matter. However, at some point, it clearly does or else we wouldn't have to pay taxes, and the government could just send everyone a check every month to pay their bills. Clearly, we know that won't work. So, this money printing is like pushing an economic nuclear button. At some point, something is going to go bang.

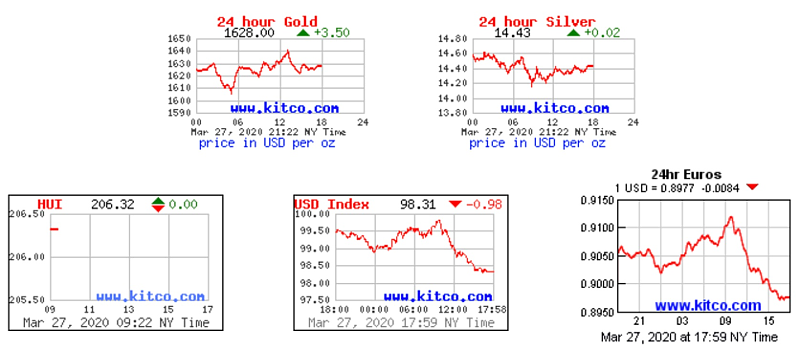

So, while there is a reason for optimism that gold prices are going higher, the banksters are still playing their games. The HUI is at 206, yet gold is at $1628! That's terrible. The banksters have done an excellent job keeping everyone's eyes off gold/silver and the miners. Most retail investors like silver, but no one is excited about paying the huge premiums for physical. I know that one of my relatives thought the premium was too high and balked, I'm sure many have the same opinion. The banksters are doing a good job keeping excitement away from gold/silver and the miners. That said, I think our time is coming. If gold can get over $1700 and silver above $18, we should see some serious mojo in physical and the miners.  |

Follow