Subscribe Now - Standard: only $299 per year or Premium: only $399 per year - Click Here

|

|

Login:

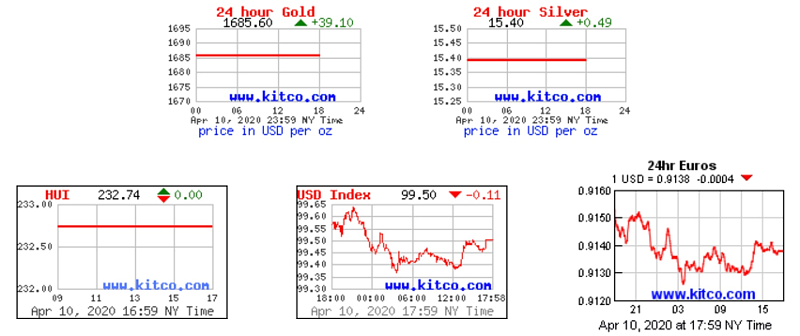

Friday Recap - 10th April 2020The gold price below shows $1685. That is from Kitco's website. However, the price at PM websites, such as APMEX.com, is $1703. And the future's price on Investing.com is $1752. I think we can consider the weekly close over $1700. That's the first time that has happened since 2011. The odds are now getting better that we will make a run at a new high above $1935.

I am still waiting for silver to catch up and join the party. Little sister is still worried about something, but I'm not sure what. The GSR is at 108 at the moment (1703/15.68). It's pretty crazy when the gold miners are seeing very high free cash flow, and the silver miners are still losing money. The average all-in for the gold miners is about $1300, perhaps a bit higher. For silver miners, it's at least $16. As gold & silver mining investors, we can't be happy at the moment because of the low silver price. But physical silver demand should remain strong and push silver prices higher in the near term. The last thing we want to see is $2,000 gold and $20 silver and a GSR of 100. 2020 is setting up as a good year for gold miners. Many of them are going to have a lot of free cash flow. The unknown question is will the economy rebound and suck money out of gold? Put another way, will MMT work? Can the Fed kick the can down the road once again? This week the Fed basically bailed out the entire US bond market (corporate bonds, municipal bonds, and state bonds) with a $4 trillion backstop. They are paranoid that any weakness in the bond market could bleed into the US Government bond market. They are right to be nervous. The debt bubble is real and it is huge. Stay tuned.  |

Follow