Subscribe Now - Standard: only $299 per year or Premium: only $399 per year - Click Here

|

|

Login:

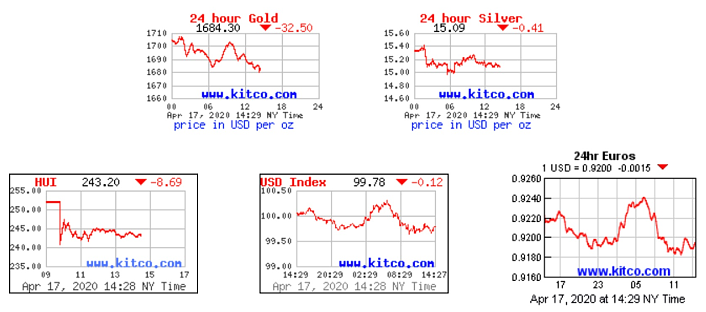

Friday Recap - 17th April 2020Gold had a good week, although not a great close. The spot price closed over $1715 yesterday, but was down $32 today to $1684. The futures price is currently at $1695. The futures price has been over $1750 most of the week, but was beaten down today on Friday. Funny how that happens. The HUI traded over 250 this week for the first time since February, and you have to go back to 2016 since we had another close over 250.

But the chart that is really interesting is GDX, which is a large-cap miner ETF. Notice all of the green arrows, which highlight significant closes. We have been in a channel since 2016, when we had our last gold break out. The GDX went to 30 in 2016, then broke down to 18. Since 2016, it has now retested 18 twice and it held both times. Look what has happened since February. We reached 30 and then broke down to 18. But, alas, we have quickly rebounded back to 29.92. If the GDX can get above 30, I think it could be off to the races. It's a chart to watch.  Captured 2 hours from the close:  |

Follow