Subscribe Now - Standard: only $299 per year or Premium: only $399 per year - Click Here

|

|

Login:

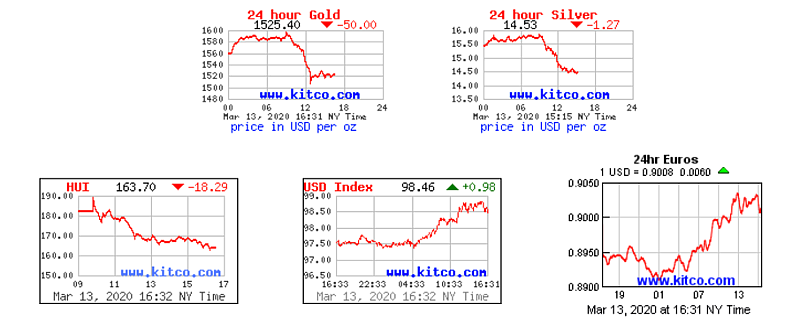

Friday Recap - 13th March 2020I've always been leery of Friday the 13th, well this was the worst one of my life. The last two days have been brutal. Big institutional money sold their miners, getting out of any risk-on trade. GDX and GDXJ were pummeled, which carried over into the stocks. The HUI crashed from 217 on the Thursday open to 163 on the Friday close. Ouch!

Not only was institutional money selling miners, but the banksters went after gold and silver (never waste a crisis!). Gold opened today up around 6% and near $1600 and then got pummeled with billions in paper sales (not physical!). The asset that got taken out to the shed was silver, crashing to $14.50, with the GSR up to 105. Lastly, the dollar came to life, jumping to 98. Ouch. It seems like everything went wrong this week for PM investors. Unless you were one of the wise ones that knew that cash is the best thing to hold during a crash. If you are cashed up, good for you. The pickings are plentiful. What happens next? Well, I think that depends on the virus. If it spreads throughout Europe and the USA, then the financial markets will likely experience a crisis. That could push stocks below 20K and gold below $1450. Next week on the 18th, the Fed will lower rates, and gold should get a bounce. Hopefully, $1450 is the floor. Time will tell. Silver dropped to $14.50 so fast that I think they could push it down below $13, but I doubt it will stay there very long. The PM websites are getting plenty of buyers at $14.50.  |

Follow