Subscribe Now - Standard: only $299 per year or Premium: only $399 per year - Click Here

|

|

Login:

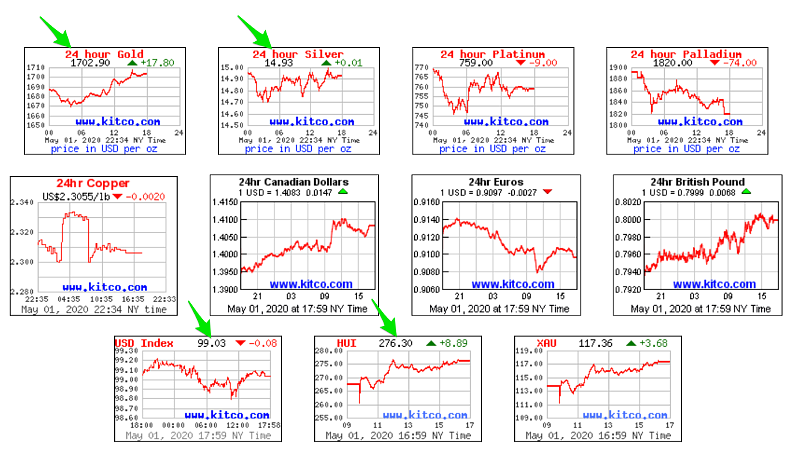

Friday Recap - 1st May 2020This was a good week for the PM miners and gold. Perhaps gold didn’t rise much, but it closed above $1700 for the second week in a row. The high gold price has begun to move the miners higher, which is reflected in the HUI at 276. If you remember, back in March the HUI was under 200 after the initial selloff in the markets. So, the miners have been trending. Hopefully, any corrections (which will come) will be shallow and short. I think there is a chance that $1600 could hold, although we could go down somewhere between $1500 and $1550. I do expect $1500 to hold during May.

Silver is stuck, which I wrote about in the newsletter. I don’t expect silver to break out until the market finds a bottom. Silver clearly expects more selling in the market and is still acting like a commodity. The dollar finally dropped below 100. It has been very strong while all of this money printing has taken place in the last few weeks. Hopefully, it will now trend lower because a lower dollar will support gold.  |

Follow