Subscribe Now - Standard: only $199 per year or Premium: only $299 per year - Click Here

|

|

Login:

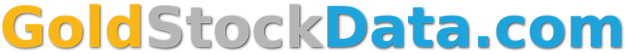

Friday Recap - 3rd April 2020Gold remained strong this week and closed around $1645. The Kitco chart shows $1617 below, but Investing.com shows $1645, which I think is more accurate. One thing we know, gold currently has a bid for physical. I don't think we will go below $1450 in the near term, although the low $1500s could easily occur with some bankster beatdowns.

Silver didn't do anything this week and the spot (paper) price is still way below the physical price. The premium for an ASE (American Silver Eagle) is currently 75% on APMEX.com. However, the GSR for the physical price is around 75% ($25 / $1800). Ironically, a 75 GSR would be about right for this point in the recession. I think we go lower in stocks and miners in the near term. The markets are a mess and there will be no good news for a few weeks. The bond market will only get worse the rest of April. We will see a lot more bad news. Small businesses are getting screwed by the bailout. Check out the article on ZH today. Most of the banks are using a narrow criteria for who qualifies. My guess is less than 25% of small businesses will get any help. I think the stock market will retest 18,000 in the next two weeks. That is a critical level. If it doesn't hold, then here comes 16,000 or 15,000. Gold and the dollar are the big wildcards and the reason I would not sell any shares or trade. At some point (out of the blue), gold could jump $100. The same is true for the dollar, although in the opposite direction (crashing). I think that the dollar crash is down the road a ways. In fact, the dollar could easily rally for a while before it begins its descent. This is likely the dollar's last stand after this torrential flood of money printing.  |

Follow us on: